- Horizon AI

- Posts

- Google Mimics Nvidia, Bankrolling AI Infrastructure to Push Its Chips 🚀

Google Mimics Nvidia, Bankrolling AI Infrastructure to Push Its Chips 🚀

Create your Clothing Line Presentation with AI 👗

Welcome to another edition of Horizon AI,

Google is fundamentally altering its strategy by emulating Nvidia's successful playbook: not just selling chips, but controlling the entire stack, from custom hardware to the software ecosystem.

Let’s jump into it!

Read Time: 4.5 min

Here's what's new today in the Horizon AI

Google Mimics Nvidia, Bankrolling AI Infrastructure to Push Its Chips 🤖

49 U.S. Startups Hit the $100M Mark in 2025, Matching Record Pace and Shattering Valuations

AI Tutorial: Create your Clothing Line Presentation with AI

AI Tools to check out

AI Findings/Resources

The Latest in AI and Tech 💡

AI News

Google Mimics Nvidia, Bankrolling AI Infrastructure to Push Its Chips

Google has quietly adopted Nvidia's strategy, now using its strong balance sheet and credit rating to finance AI data centers and accelerate the adoption of its custom chips (TPUs). This financial maneuver signals a shift: AI isn't just a technology race anymore, it's a capital-intensive infrastructure war.

Details:

Google has committed to underwriting lease-back deals. For example, a recent arrangement giving up to U.S. $1.8 billion to backstop data-center leases for partners deploying Google's TPUs.

Through these deals, Google becomes both "vendor and lender": it helps build AI-ready facilities, secures capacity for its chips, and obtains equity warrants (roughly 8%) in partner firms.

This mirrors Nvidia's prior lease-back strategy with GPU deployments, but Google's take is broader: insulating infrastructure risk to encourage broader TPU adoption, even outside its own cloud.

The strategy is part of a broader wave: hyperscalers (including Google, Meta, Amazon, etc.) have issued over U.S. $75 billion in investment-grade bonds this fall alone, more than in the previous three years combined, raising concerns among bond investors.

As TPUs gain traction outside Google, the long-dominant GPU-centric model may face a real challenger: a shift from monopoly hardware vendors toward diversified, vertically integrated infrastructure providers.

TOGETHER WITH CASH APP

3 money habits teens can start building now

With a Cash App Card, teens can take their first steps toward independence with a secure debit card. They’ll learn how to spend, save, and manage money, all with your guidance and oversight to help them get started.

Learn to spend responsibly

A debit card gives them a safe way to practice managing money under your supervision. It gives you the opportunity to teach them how to make smart spending choices.

Start saving for their goals

Setting goals can help them see how saving a little at a time can help them reach their short-term and long-term goals.

Manage their own money

Whether they get paid with direct deposit or use Cash App to get allowance or gifts, they get real experience with money.

Cash App is a financial platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms & Conditions. To view the eligibility requirements for sponsoring a teen, please visit the Sponsored Accounts section of the Cash App Terms of Service.

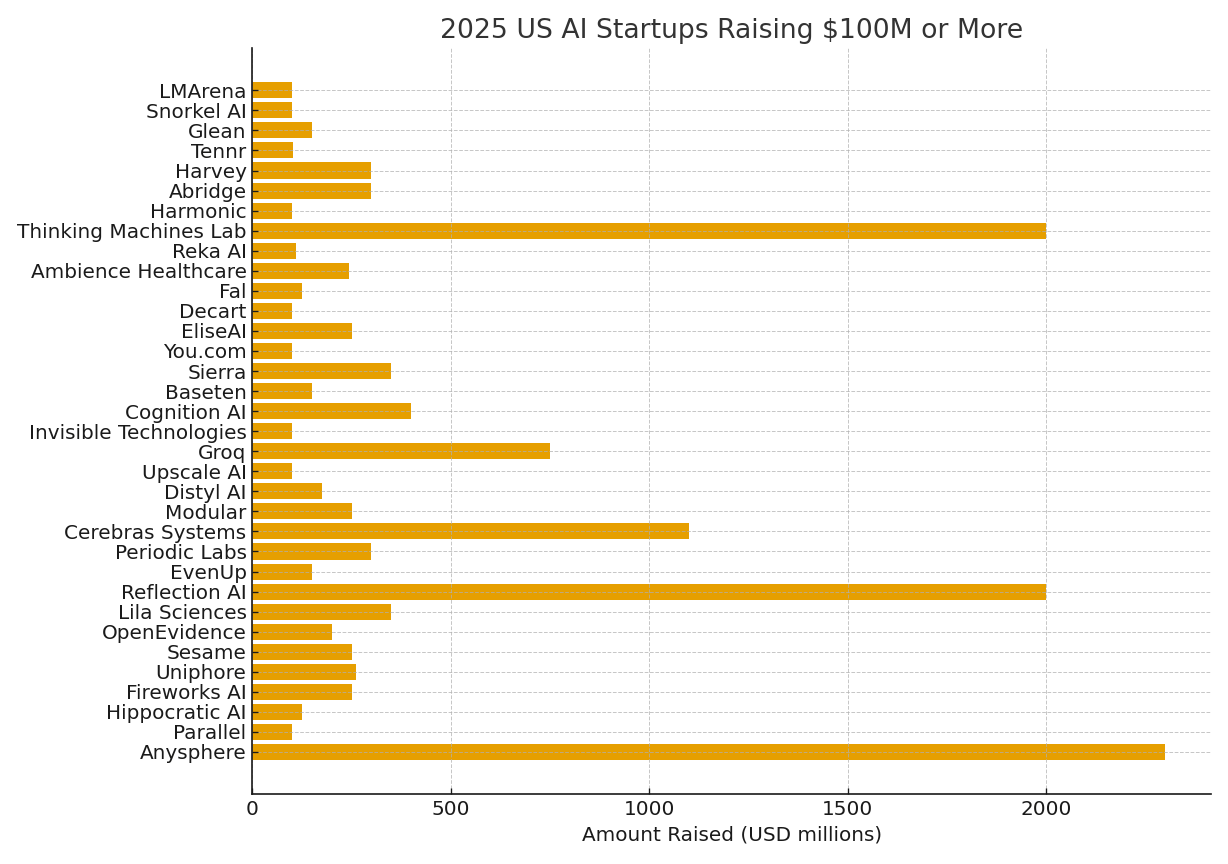

AI STARTUPS

49 U.S. Startups Hit the $100M Mark in 2025, Matching Record Pace and Shattering Valuations

Investors continue pouring capital into artificial-intelligence ventures across sectors. As of late November 2025, 49 U.S.-based AI startups have closed funding rounds of at least $100 million, matching the record from 2024, even before the year ends. This reflects enduring confidence in AI's long-term potential across infrastructure, enterprise tools, and healthcare.

Details:

As of late 2025, 49 U.S. AI startups secured funding rounds of $100 million or more, matching the high-water mark set in 2024, and more rounds are rumored or pending, suggesting that 2025 could surpass 2024.

An estimated 70% of all U.S. startup funding this year went toward these jumbo-sized financing rounds, indicating capital is flowing into established, high-potential AI ventures.

The list was headlined by massive raises, including:

OpenAI's record-breaking $40 billion round, at a $300 billion valuation.

Anthropic secured multiple rounds, totaling over $16 billion in 2025.

Anysphere (Cursor) raised two mega-rounds, sending its valuation soaring to nearly $30 billion.

The most heavily funded categories spanned essential segments of the AI economy:

Foundational Models/Research Labs (OpenAI, Anthropic).

AI Infrastructure/Hardware (Cerebras Systems, Lambda).

Healthcare AI (Abridge, Hippocratic AI).

Legal Tech and Coding (Harvey, Anysphere).

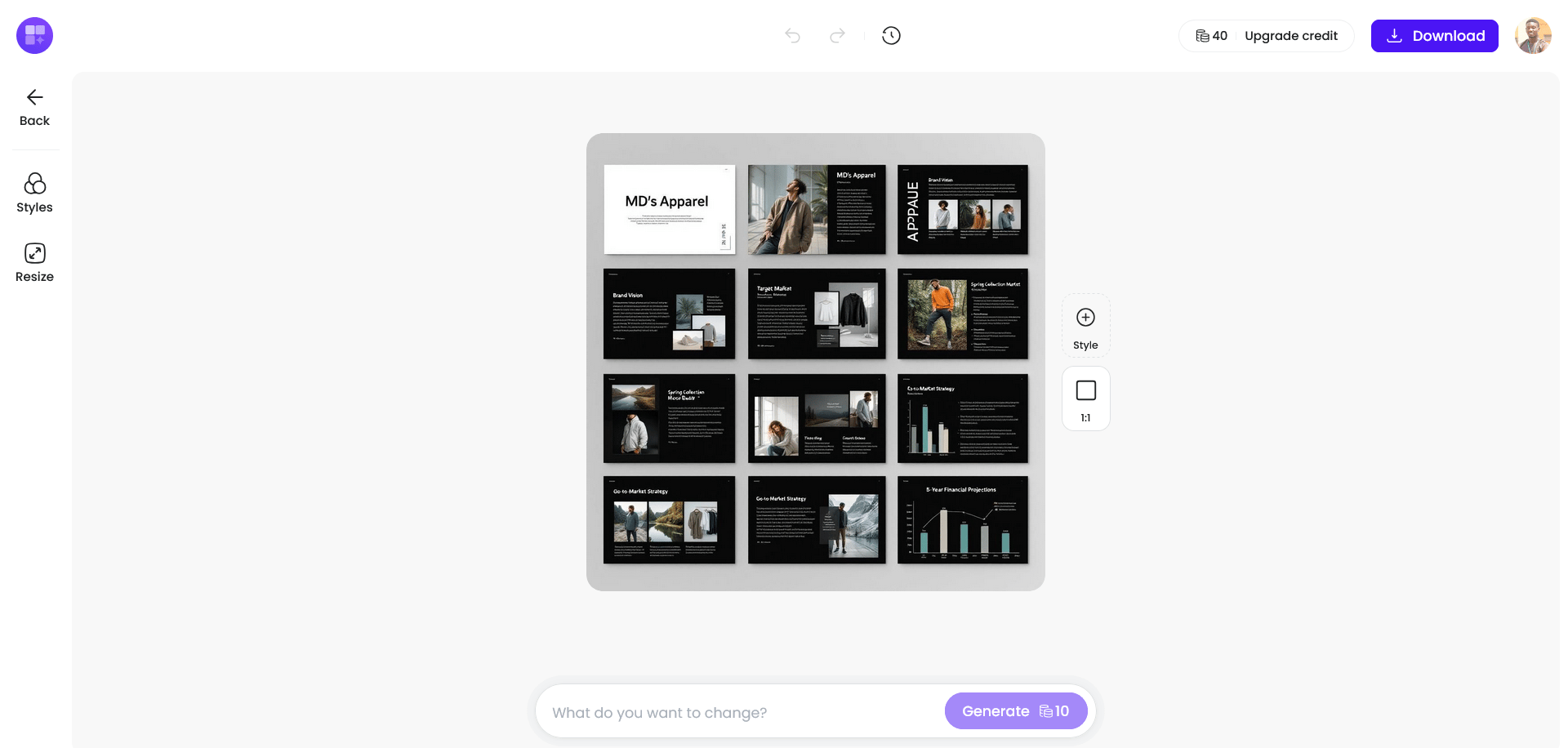

AI Tutorial

Create your Clothing Line Presentation with AI

Log in to Designs.ai and select the Presentation Maker.

Enter a detailed prompt that defines the clothing line's goal, its audience (investors/buyers), and the required slides (e.g., Brand Vision, Target Market, Spring Collection Mood Board, Financials).

For Example:

"Create a 10-slide pitch deck for a new sustainable women's activewear line called 'MD’s Apparel.' The target audience is venture capital investors. The presentation must cover: Brand Vision, Target Market, Spring Collection Mood Board, Go-to-Market Strategy, and 5-Year Financial Projections. The tone should be modern, minimalist, and confident."

Choose the best AI-generated template that matches your brand's style (e.g., minimalist, modern).

Now go for brand Integration and upload your logo, brand colors, and specific fonts.

Add the essential Visuals by replacing all stock photos with high-resolution images of your actual clothing line, lookbook photos, and mood board collages.

Insert your specific financial data, review the copy for tone, and export as PPTX or PDF.

AI Tools to check out

📞 Klariqo AI: AI assistant handles every phone call, every website visitor, all the time.

📝 Gitmore: AI agent that writes reports while your Team codes

🛠 Raydian: A platform optimised for building with AI and refining by hand

📚 Haxiom: The Online MD editor that uses AI to organize your team's knowledge.

✨ Hirecarta: Learn your stories and accomplishments and transform your job search.

TOGETHER WITH DEEPGRAM

Voice AI Goes Mainstream in 2025

Human-like voice agents are moving from pilot to production. In Deepgram’s 2025 State of Voice AI Report, created with Opus Research, we surveyed 400 senior leaders across North America - many from $100M+ enterprises - to map what’s real and what’s next.

The data is clear:

97% already use voice technology; 84% plan to increase budgets this year.

80% still rely on traditional voice agents.

Only 21% are very satisfied.

Customer service tops the list of near-term wins, from task automation to order taking.

See where you stand against your peers, learn what separates leaders from laggards, and get practical guidance for deploying human-like agents in 2025.

AI Findings/Resources

⚡ Estimating AI productivity gains from Claude conversations

🔮 What AI might look like in 2026: A Quick Vision

🤝 AI will redefine human work, not replace it, through new collaboration and fluency

🛡 New approaches to reducing privacy leaks in AI by Microsoft Research

The latest in AI and Tech

xAI Eyes December Funding Round as Musk Advances Next-Gen AI Ambitions

The company backed by Elon Musk is reportedly seeking fresh funding this December, a move that could supercharge its AI development pipeline amid intensifying competition.

Nvidia Pushes DIY AI Creativity

NVIDIA highlights how users can leverage its RTX hardware and new tools like "Garage" for AI-driven design and creation, signalling a push to democratize AI-powered creative workflows.

Alibaba CEO Doubts AI Bubble

The leader of Alibaba argues that despite recent volatility, the AI boom won't implode anytime soon, citing strong fundamentals and long-term demand across Asia.

Investors on Edge as Debt-Fueled AI Cloud Bets Continue

According to experts, big tech firms are increasingly tapping debt markets to fund AI and cloud expansions, a sign of confidence in long-term growth but also a financial gamble if AI returns don't materialize soon.

Bond Investors Taking a One-Way Ride on AI's Big Dipper

A new commentary warns that bond investors may be riding a high-risk wave as they pile into debt issued by AI-heavy firms, betting on the hype more than on proven returns.

That’s a wrap!

We'd love to hear your thoughts on today's email!Your feedback helps us improve our content |

Not subscribed yet? Sign up here and send it to a colleague or friend!

See you in our next edition!

Gina 👩🏻💻